nhs pension contributions

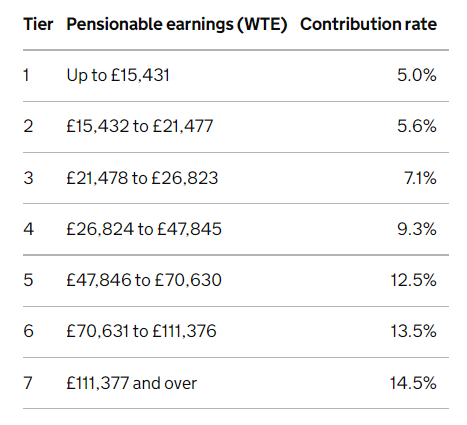

The employers contribution rate changed from 1438 to 2068 on 1 April 2019 which includes a scheme administration charge of 008. Pension Example For example someone on 10000 perhaps a part time domestic will only pay 5 towards their pension whereas a Cheif Executive who will earn upwards of 150000 a year will have to pay 145 towards their pension.

|

| Pensions Onehr |

Proposed changes to member contributions from the 1 April 2022 For members in England and Wales The Department of Health and Social Care are consulting on the implementation of a new member contribution structure for the NHS Pension Scheme in England and Wales.

. This service is for NHS employers who pay into the NHS Pension Scheme. How do I claim a refund of my NHS Pension contributions. Your employer will continue to contribute 206 per cent of your pensionable earnings towards your pension each month. If youre an admin user youll also be able to manage accounts.

Pension scheme contributions are net of tax. For higher rate tax payers contributions at the rate of 125 would equate to a net 75 contributions at the rate of 135 would equate to a net 81 and contributions at the rate of 145 would equate to a. NHS Pension Scheme. Have not had a transfer into the NHS Pension Scheme from a personal money.

Contribution rate from 1 October 2022 based on actual pensionable pay. There is an employer charge of 008 for administration costs in addition to employer contributions at a rate of 206 of salary from April 2019. Wednesday 22 June 2022 1pm - 3pm - Guide for new NHS pensions administrators Thursday 23 June 2022 1pm - 3pm Guide for. You may have to take a refund of contributions if.

New member contribution structure. Were under your Normal Pension Age NPA when you last paid pension contributions. You may be entitled to a refund of your pension contributions if you. Are no longer contributing to the Scheme.

Therefore the true cost of the contributions is lower than the gross rates quoted above. Member contribution rate for 20212022. Use this service to make payments for. For more information go to our Cost of being in the Scheme page.

The NHS Pension Scheme has 17 million members actively contributing 713000 deferred members and 1 million pensioners receiving benefits. Member contribution rate for 20212022. Your monthly take-home pay may be affected by these changes. We can confirm that there will be no changes to the member tiers and.

If you work part time we use your whole time equivalent pay to work out your contribution rate. In March 2019 the consultation response announcing the rise the Department of Health and Social Care DHSC confirmed the available funding to meet the associated costs and that a transitional. The new structure will take effect from the 1 April 2022. The NHS Pension Scheme is a defined benefit public service pension scheme which operates on a pay-as-you-go basis.

Regardless of whether the member is in receipt of paid or unpaid leave the employers contribution rate will always remain at 1438 which includes a 008 administration charge. As the NHS Pension Scheme has moved from final salary linked to a career average revalued earnings CARE model all members will build up CARE benefits from 1 April 2022. Under all circumstances employer pension contributions are based on the normal pensionable pay as though the member was not on maternity leave. A new reformed scheme was introduced on 1.

Have less than 2 years qualifying membership in the Scheme. The amount you pay into the NHS Pension Scheme may change from 1 October 2022. This process takes around 5 minutes to complete. This change ensures.

The current member contribution rate tiers will be extended to 31 March 2022. Contribution rate based on whole-time equivalent pensionable pay. NHS Pension Scheme employer contribution rates 202223 The NHS Pension Scheme employer contribution rate increased on 1 April 2019 from 143 to 206 plus the employer levy of 008. Pension contributions are taken before Tax and National Insurance is calculated and deducted.

Contribution rate based on actual pensionable pay. If you have more than one NHS employer you only need to submit one RF12 form and this should go to the most recent employer to which the refund period relates. The amount you contribute to the Scheme is based on your pensionable earnings. You have less than two years of qualifying membership and have left NHS pensionable employment or the scheme.

Refunded NHS Pension contributions include any AVCs additional voluntary contributions you may have made during your membership. This table tells you your contribution rate. As of 2016 the tiered employee contribution rates. To claim a refund you will need to complete an RF12 form and submit this to your employer.

The RCM is calling for an inflation busting pay rise to offset the higher pension contributions and the rapidly rising cost of living. The form can be found on our website. Contributions are based on your previous years pensionable earnings and are shown below as a percentage of gross salary before tax relief. The pushing back of pension contribution increases was to help NHS staff cope with rising prices and inflation.

The foundation course is available to all employer types of the NHS Pension Scheme and the events will be held on the following dates in June. The amount of pension youll receive in retirement will not be affected by these changes. A recommendation on pay for Agenda for Change staff from the NHS pay Review Body is also expected soon. Adjustments for previous months.

How much you pay into the Scheme is based on your pensionable earnings or whole time equivalent if you work part time.

|

| Nhs Pension Scheme Why Are So Many Workers Opting Out |

|

| Many Nurses To Be Hit With Nhs Pension Contribution Increases Nursing Times |

|

| Your Nhs Pension After 1 April 2022 Nhsbsa |

|

| Nhs Pension Banding Nhs Sbs |

|

| Nhs Pension Contribution Changes April 2022 |

Posting Komentar untuk "nhs pension contributions"